Exness Registration in Indonesia

Exness is an online broker that allows users to trade various financial instruments including currencies, stocks, commodities, cryptocurrencies and more. Founded in 2008, Exness has grown to serve clients in over 120 countries and became one of the largest brokers in the world with a daily trading volume exceeding $30 billion.

Brief overview of the broker Exness

Exness sets itself apart by offering some of the lowest spreads and commissions in the industry without sacrificing reliability or execution speeds. They provide access to powerful trading platforms such as Exness MetaTrader 4 and Exness MetaTrader 5 for web, desktop and mobile devices.

Exness broker is regulated in several major jurisdictions including the UK’s Financial Conduct Authority (FCA) and Cyprus Securities and Exchange Commission (CySEC). These strict regulations require Exness to maintain transparent operations, robust risk management and safeguard client funds in segregated accounts.

Opening an Exness ID Account

Registering an account with Exness in Indonesia is straightforward whether traders prefer accessing the desktop-based WebTerminal platform or using the Exness mobile apps for Android and iOS devices.

Sign up in Exness WebTerminal

The browser-based Exness WebTerminal platform provides traders a full-capability desktop trading experience through an intuitive web interface accessible on any internet-connected device. Registering an account only takes a few quick steps:

- Go to Exness.com and locate the “Register” button in the top right section of homepage

- The registration form asks traders to enter an email address to open account

- Next, traders must create a secure password following minimum complexity requirements

- After submitting registration details, Exness emails verification link to confirm trader’s email

- Click the verification link inside the email to officially complete the signup process

- Log into the Exness account to deposit funds via major credit cards or wire transfers

- Navigate WebTerminal platform to access 40+ currency pairs and CFDs with ultra-tight spreads

- Use built-in technical analysis tools, custom indicators and automated trading bots as desired

The Exness WebTerminal streamlines registration so traders can quickly enter email, password info and email verification to rapidly open a secure account in minutes. From there, the full-scale capabilities of the Exness trading platform become accessible from any web browser.

Over 2 million people worldwide have chosen a global leader in online financial trading & investment.

Registration in the Exness mobile application

For traders seeking advanced trading apps for mobile devices, Exness offers Android and iOS applications with comprehensive charting, analysis tools and one-tap execution.

The registration process in the Exness mobile app only requires a name, email address and phone number. Password creation and email verification complete the quick account opening process.

With an Exness account registered through the mobile app, Indonesian traders can fund their accounts and immediately start executing trades with ultra-low spreads. Advanced order types and charting make mobile trading efficient.

Verifying Your Identity

To withdraw funds from the account, Indonesian traders must complete Exness identity verification by providing:

- Full legal name

- Date of birth

- Address documents less than 6 months old like utility bills

- Photo ID such as national ID card or Indonesian passport

- Selfie photo holding the ID document

Submitting these documents through the online verification form allows Exness to confirm a trader’s identity in line with anti-money laundering regulations before live account deposits and withdrawals.

Choosing the right type of account at Exness

Exness provides Indonesian traders 5 main account types to match different trading strategies:

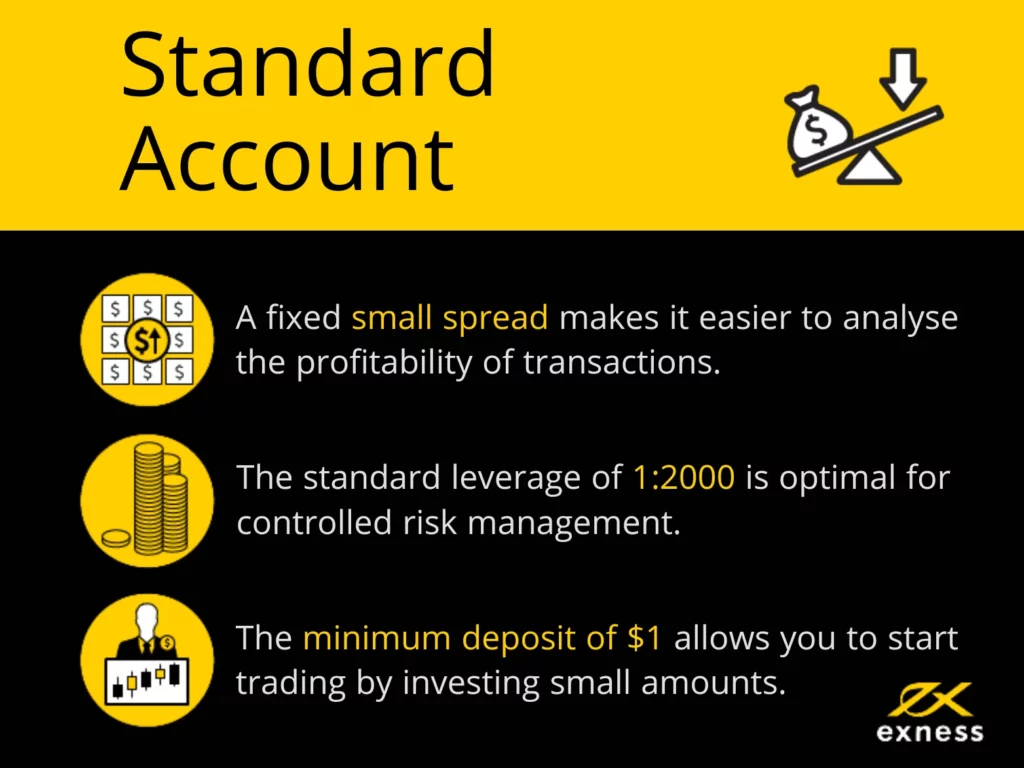

- Standard accounts have tight variable spreads as low as 0.1 pips with a minimum deposit of $1. This remains the flagship account model at Exness.

- Standard Cent accounts offer pipette-quoted pricing for precision trading across all markets with a $1 minimum deposit.

- Raw Spread accounts provide straight-through direct market access pricing on tight spreads without any markup commissions or fees. The minimum deposit is $200.

- Zero accounts give traders access to ultra-low cost trading across over 70 currency pairs and CFDs without any commissions. Minimum deposit is $200.

- Pro accounts cater to advanced traders seeking premium spread discounts, dedicated account managers and other VIP services for deposits over $50,000.

Creating a demo account before going live

For Indonesian traders uncertain about which account best matches their skills or strategy, Exness provides unlimited demo accounts. These practice accounts come preloaded with $10,000 in virtual funds to simulate real market conditions.

By demo trading for a period, clients can test different position sizes and analysis methods to determine which Exness account model suits them best without risking real capital. Demos also help new traders gain experience before depositing cash.

6 Asset Classes – 16 Trading Platforms – Over 1000 Instruments.

Trade Forex, Individual Stocks, Commodities, Precious Metals, Energies and Equity Indices at Exness.

Common mistakes when registering with Exness

Indonesian traders can avoid headaches by steering clear of these common mistakes when signing up for an Exness account:

Avoiding these common oversights streamlines the Exness account opening and verification process considerably.

Why Exness is a great choice for traders in Indonesia

From ultra-low trading costs to advanced platforms and quality education, Exness brings major benefits to Indonesian traders that many rival brokers cannot match, including:

From minimizing spreads to stabilizing execution to delivering high-quality education, Exness simplifies the path to prosperity for traders of all skill levels in Indonesia.

FAQs

Is Exness legal in Indonesia?

Yes, Exness holds regulation licenses from top-tier authorities like the UK’s Financial Conduct Authority (FCA) and Cyprus Securities and Exchange Commission (CySEC) that allow them to legally offer online trading services to clients from Indonesia.

What ID verification documents does Exness accept from Indonesian traders?

Exness accepts all standard national IDs, including KTP cards, SIM cards, passports and Indonesian driver’s licenses. For address verification, documents like recent utility bills, bank statements or tenancy agreements no more than 6 months old are accepted.

What payment options can I use to fund my Exness account in Indonesia?

Indonesian traders can deposit using major credit/debit cards, e-wallet platforms and direct bank transfers in IDR currency. Top options include Visa, MasterCard, UnionPay cards, Skrill, Neteller, Fasapay and Indonesian direct bank transfers. When selecting your Exness deposit method, consider processing times, fees and limits to pick the optimal funding choice.

How to register an Exness demo account?

Exness demo accounts just require an email and password with no obligation to deposit real money. Using the demo allows testing platforms risk-free before going live. Simply click the “Register” button at the top of Exness.com to get started.

What are the requirements for registering Exness in Indonesia?

The registration requirements are an email address, phone number and password. Identity verification only happens later before withdrawing funds. Overall, opening an account with Exness from Indonesia is quick and hassle-free.

6 Asset Classes – 16 Trading Platforms – Over 1000 Instruments.