[Special content for WSAS readers: I do an employment preview every month. This month I did not comment on trading. My experience has been that even when the report seems solid, there is usually a buying opportunity later in the day. Partly this is a result of the complexity of the report -- two different surveys and many sub-categories to consider. There is always something to be skeptical about. If all else fails, someone will say "birth/death adjustment" with a roll of the eyes. For this reason, I am always cautious about buying in front of this report.]

Friday’s employment situation report is the big statistical release of the week. Billions in market cap will swing on speculative conclusions about preliminary survey data.

The question is so important that we insist on making unwarranted inferences.

This month we have a special treat. We have a timely update on how the BLS is doing with their estimates. If you (unwisely) choose not to think about the problems in the competing methods, then skip to the conclusion for some data you will not see anywhere else.

The Data

We all want to know whether the economy is improving and, if so, by how much. Employment is the key metric since it is fundamental for consumption, corporate profits, tax revenues, deficit reduction, and financial markets.

We would like to know the net addition of jobs in the month of January. This data point is actually a fact, but something that we do not know yet. Eventually we will have this information with a high degree of certainty. It takes about eight months. State employment offices provide data that are used for the benchmarking of the official BLS data. This information is solid, since businesses do not exaggerate employment when it comes to paying taxes.

By the time we have this information, everyone will treat it as “old news.” Markets, news sources, and pundits all want to talk about something, and like a spoiled child, they want it RIGHT NOW!

To provide an estimate of monthly job changes the BLS has a complex methodology that includes the following steps:

- An initial report of a survey of establishments. Even if the survey sample was perfect (and we all know that it is not) and the response rate was 100% (which it is not) the sampling error alone for a 90% confidence interval is +/- 100K jobs.

- The report is revised to reflect additional responses over the next two months.

- There is an adjustment to account for job creation — much maligned and misunderstood by nearly everyone.

- The final data are benchmarked against the state employment data every year. This usually shows that the overall process was very good, but it led to major downward adjustments at the time of the recession. More recently, the BLS estimates have been too low.

I think the BLS is honest and does a good job, which seems to put me in a small minority of observers. Despite this support, I question the general concept. The BLS tries to estimate total employment in one month, total employment in another, and subtract the two to determine the difference. When you are talking total payroll employment of over 130 million jobs, even small errors are in the range of 100K jobs or more. Meanwhile, smaller discrepancies from expectations are unwisely viewed as significant.

Competing Estimates

If you accept the idea that the final benchmarking is accurate, then the BLS approach should be viewed as an initial estimate, not the ultimate answer. What we are all looking for is information about job growth. There are several competing sources using different methods and with different answers.

- ADP has actual, real-time data from firms that use their services. The firms are not completely representative of the entire universe, but it is a different and interesting source. ADP sees gains of 170K private jobs. There is a continuing trend of losses in government jobs.

- TrimTabs looks at income tax withholding data. The idea is that this is the best current method for determining real job growth. They see job gains of only 45,000.

- Economic correlations. Most Wall Street economists use a method that employs data from various inputs, sometimes including ADP (which I think is cheating — you should make an independent estimate). I use the four-week moving average of initial claims, the ISM manufacturing index, and the University of Michigan sentiment index. I do this to embrace both job creation (running at over 2.5 million jobs per month) and job destruction (running at about 2.3 million jobs per month). In mid-year the sentiment index started reflecting gas prices and the debt ceiling debate rather than broader concerns. When you know there is a problem with an input variable, you need to review the model. For the moment, the Jeff model is on the sidelines.

The problem with all of these methods is the scoring system. Everyone foolishly takes the BLS estimate as “official” even if the other approaches eventually turn out to be more accurate. Let us look more closely at this question.

The Final Verdict

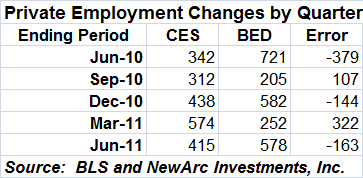

As noted in the introduction, we eventually have actual hard data from state employment agencies. This is reported via the business dynamics series, which was updated today. Eventually the big-time pundits will pay some attention to this, but for now I am virtually alone in citing these data. Here is a crucial chart:

The last column shows the error from the current BLS estimate and the final data. I am working on sharpening this up, since it is using not the original BLS estimates, but the revised version. The interpretation is that the BLS was too optimistic for the quarter ending in March — something that I noted as a concern a few months ago. We now know that they were too pessimistic for the quarter ending in June.

I believe that TrimTabs, ADP, NewArc, and other forecasters actually do as well as the BLS in the preliminary estimates. This means that the market should embrace various estimates.

It is also clear that the knee-jerk criticism of the BLS and the job creation estimation process is completely wrong. The BLS has been pretty accurate over the last year, and is actually under-estimating new job creation.

New jobs are created at a pace of nearly 7 million per quarter. If you do not know this, you don’t know Jack about employment. I am still waiting to hear this information on CNBC’s Friday morning report.

Related posts:

+0.24%

+0.24% +0.45%

+0.45%