This morning, sleepless as I stared at the ceiling, I realized that Apple had now gone up a full 10,000% since I first bought it and recommended to my subscribers when Apple hit $703 earlier this week. When I got up later, I started putting doing the math and realizing just how next to impossible it really is to see a stock climb 10,000%.

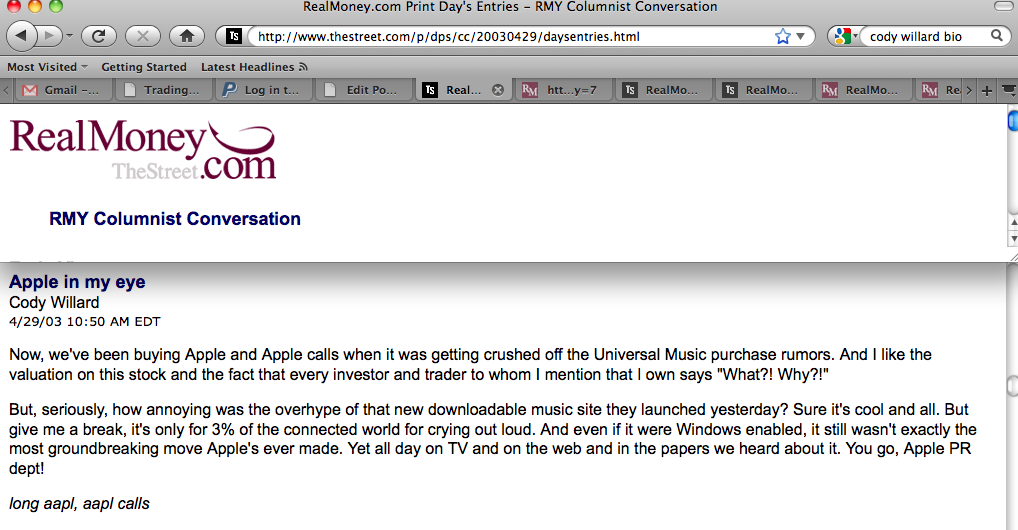

You see, almost 10 years ago, I bought common stock and long-dated call options in a struggling tech company called Apple AAPL -1.86% that was just about to roll out a new website for buying music called iTunes. Here’s a screen shot of my trading diary from when I told my subscribers for the first time about buying Apple.

- Buying Apple common and call in April 2003

The date, as you can see on there, was 4/29/2003. Here’s a graph of where Apple was trading when I entered that trade:

- Apple at $7.03 back in 2003

Apple was trading at $7.03 a share. It had about $8 per share in net cash. The company now has much more than $100 per share in net cash. That means that Apple’s market cap went up more than 10x as much as its own stockpile of cash did, as investors pay premium for future growth.

I’ve been looking for the next Apple even as I’ve kept a big Apple position all these years. Currently, I think that Fusion-IO FIO -1.26% and Facebook FB -9.06% are two potential 1,000% gainers for me, but the fact is — I don’t know that I’ll ever catch a 10,000% move in a stock in my lifetime again, much less a 10,000% move in less than 10 years’ time.

A couple years ago, I wrote a column that I entitled, “Apple’s up 4,500% since I recommended it. What now an who’s next? ” and in it, I wrote:

“It’s funny, but the same guys who wish death upon me now in my comments and who mock me around the Internet for thinking Apple can run to $1,000 by 2015 and that Google can get to $2,000 by 2020 are the same guys who were trashing me for such predictions when they were each 25% lower.”

Apple was trading at only $300 at the time I wrote that. I later moved that $1,000 price target up to 2013. And I still think that Apple will get there, as the platform the company has built its business upon and which I have so long written about, has fully come to fruition. Facebook, Baidu and Amazon are creating their own platforms and I own all three of those too, but if each stock were to go up just 1,000% from here, not 10,000%, their respective markets caps would be $400 billion. For those two stocks to go up the equivalent of what Apple has gone up since I first bought it and recommended it, they would each have a $4 trillion dollar market cap. Apple’s own market cap right now, as the most valuable company in the history of the planet, is $0.6 trillion. Were Fusion-IO to go up 10,000% from here, it would be worth $200 billion, or more than Cisco, HP, Dell, Yahoo and Nokia — combined.

What also blows the mind is the realization that Apple’s still cheap here. I do think it can run to $1,000 in the next year or so, which is just more than 30% from these levels. That would make Apple the first trillion dollar company and it would still be cheap on forward earnings and net cash balance and yield at that point. But I think I might go ahead and declare victory if and when we were to get close to $1,000.

I don’t think Apple can go up 10,000% from here. I’m not sure how many stocks in history have gone up 10,000% in a 10-year period. Do you have any stocks in your own portfolio that you think could reasonably go up 10,000% in the next decade? No penny stocks, ok?

Finally, before I go, I want to share with you an email I got from a soldier whom we’ve given a complimentary subscription to TradingWithCody.com:

Mr. Cody,

First off, I would like to continue to thank you for allowing me a complimentary subscription to your TradingwithCody. It is a very humbling experience, when kindness and gratuity is shown to myself as a service member. Thank you.

Anyways, since following your trades and insights I have to say that I am blown away. Not for the profits that I’ve made and taken using your advice, more importantly because of your ethos when it comes to trading and investing.

I had in the past played the day-trade rat race because of the fast-pace, adrenaline pumped, euphoria of hitting that swing in one direction. Catching the lighting-in-a-bottle aspect of the market is very tiring to say the least, and often times potentially catastrophic.

Due to your writings, with your views, insights, thoughts and just general way of viewing the marketplace has opened my eyes and mind in some many ways. The biggest “aha!” moment I’ve had was when you had commented on the doom and gloom back in May/June, and suggested to simply turn the charts upside down and view the downsides as if they were the upsides. That simple idea, really made me look differently at everything in the marketplace.

I’ve just built a new home for my young and growing family so I’ve had to “reallocate” my trading capital elsewhere, but will be looking to adhere strictly to “buying the panic, selling the greed” and “sometimes the hardest trade to make is the one to make”.

Really, I am impressed with your abilities and consider myself fortunate to read your work.

Thank you again, Gunnery Sergeant N***l.

I’d like to thank the good Sergeant for his kind words and especially for serving our country. And if you’re currently in the military and would like your own complimentary subscription to TradingWithCody.com, just send an email with proof of your service to [email protected] and we’ll get you set up.

Cody Willard writes Revolution Investing for MarketWatch and posts the trades from his personal account at TradingWithCody.com. At time of publication, Cody was net long Apple, Google, Fusion-IO, Facebook and Baidu. Follow Cody on Twitter at twitter.com/codywillard. Cody’s #1 best-selling Amazon book, “Everything You Need to Know About Investing,” is available in digital and in paperback.

Related posts: