I look at the political landscape and conclude that we’ve got more of the same in front of us. I think Obama will win, and the Republicans will control the legislative side. For the sake of this discussion, assume that is how it works out.

As of today, there is an economic firestorm that is programmed to hit on January 1, 2013. It’s the kitchen sink - the Bush tax cuts (all of them), the payroll tax cuts, the AMT patch, the ending of extended unemployment benefits, the Sequestered Amounts (11’ budget deal), the debt ceiling, the need to pass a continuing resolution to fund the government and a bunch of other landmines. Many of the things that have been kicked down the road during the past few year come due on New Year’s Eve.

If there is a hostile mood in D.C. (there will be) this list of “must fix” issue will be impossible to tackle following the election.

It’s difficult to see around the corner on this. One possibility is that nothing happens in the six weeks post-election. If nothing is accomplished, it would bring about an immediate and significant recession.

I say that doesn’t happen. For once, both the Republicans and the Democrats will pay a big price if there is no deal. For the Republicans, the mandatory cuts in the Military, and for the Democrats, the mandated cuts in the rest of the budget, means there has to be a deal.

But what deal could there be? The problem is enormous. The budget “hole” will be at least a trillion in 2012. It will get bigger every year. The Republicans have said “no more taxes.” The Democrats have said, “We need to spend more”. These seem like irreconcilable differences.

Fortunately, the Congressional Budget Office has come up with a solution. It’s a neat one at that. Neither overt new taxes nor cutbacks in spending would be required. This magic would be accomplished with a very big stealth tax. The CBO looked at eliminating all tax deductions. That would generate a ton of additional revenue. The CBO put the extra annual loot for the Feds at $800 billion plus, exactly what is needed.

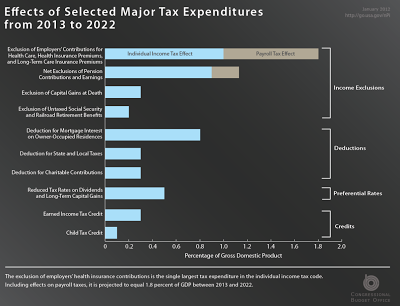

Of course the idea of cutting/eliminating tax deductions is an old one. The CBO does a super job of summing it up on one (crowded) page. The critical issue is:

The answer is:

Ah… that would come to about 250 million people. Damn near everyone chips in. The highlights:

*Forget the mortgage deduction. That would be gone. This would be a significant change in the Rent VS Buy calculation. Bye-bye housing.

*Are you working and have benefits? You will be taxed on the value of those benefits. Same thing for employer contributions to 401Ks. You will have the same income, but your taxes will be higher.

Do not be confused; this is not a tax increase. Both Parties will tell you so.

*A geezer on Social Security? Your benefits are going to get taxed (much more).

*Don’t bother having kids, the child deduction is gone.

*Live in a State with an income tax? You’re about to be hosed big time. NY and Cali will end up paying an ever-higher percentage of total federal taxes.

*Feel good about giving some money to a worthy charity? You won’t any more. That deduction will be gone too.

*Trying to save a buck? Dividends and Cap Gains will no longer have preferential treatment. Under this plan, short-term gains will be taxed the same as long-term gains. The “Casino” will move to the short-time horizon. The Wall Street crowd will welcome the new (and needed) players.

It’s easy to say that this could never happen. It never has before. Every special interest group would be whacked. But before you dismiss it, consider what will be happening in the weeks between November 10 and December 31. America will be on the edge of a cliff. The option described by the CBO is the only thing that is both politically feasible and large enough to fill a very big bucket.

The CBO one pager follows. Where are you on this list? Where do you expect to be on this list in five-years?

+0.17%

+0.17% +0.97%

+0.97% -1.07%

-1.07%