Oh my goodness, stop the press. Did you hear about the EU debt crisis? Don’t you know that the sovereign debt and banking crisis in the EU is going to derail the U.S. multinational corporate boom and matching bull market?

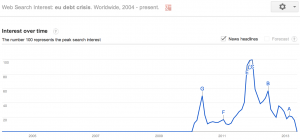

Here’s the Trader’s Chart of the Day, a history of the Google search trends for “EU debt crisis”:

I’ve repeatedly pounded the table whenever the markets have tanked for the last few years, especially when the purported reason for such a tanking was the “EU debt crisis.” As I often remind you, whatever you see dominating the financial headlines is usually already more than priced in. Go look at WSJ.com and Bloomberg.com. Can you find headlines on the EU crisis; the very same ongoing EU debt crisis that dominated the headlines when the markets were 20%, 40% lower than they are now?

Here are a few more headlines and some Revolution Investing commentary and analysis from yours truly to go along with them.

JPMorgan Joins BofA With Perfect Trading Record in Quarter – It helps to have friends in high places who telegraph if not outright tell you what the next huge trade taxpayer funds will be making. I remain convinced that JPM’s balance sheet and profitability are in big trouble despite the ongoing stock market bubble that inflates the stock price.

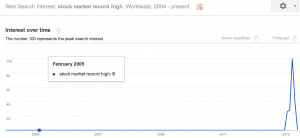

U.S. Stocks Flat After S&P 500 Climbs to Record High – Record high? Remember the chart above that outlined Google Search Trends for “EU debt crisis”? Here’s a Google Search Trends chart for “Stock market record high.” If the time to buy stocks was when EU debt crisis was dominating, then couldn’t the argument be made that when this chart peaks it’ll be the right time to sell stocks?

The DJIA is headed to 20K – To Jeff’s credit, he first called for a DJIA 20k target back when the DJIA was at 10k. Still, 20k before the next crash? Can you imagine the opportunity to profit for those willing to go against that bubble if it got to that level? Then again, can you imagine the many shortsellers and bears that have been crushed by betting against that bubble already?

Jobless Claims in U.S. Unexpectedly Fall to Five-Year Low – Everybody now realizes that, as I’ve been saying since 2009, there are now two disparate economies in this country — the corporate economy is booming. But the average Joe’s economy probably isn’t as good as these types of indicators show. Which segues me to the next link.

Poll - How is economy you deal with every day doing? – Click through and let us know how well your own economy is going. I’ll write up a full article with analysis on the results next week.

Vroom Vroom … Tesla’s Near-Perfect Day – The time to short a company is often when the headlines proclaim its perfection. I don’t think today’s the day to do it with Tesla TSLA +10.16% , and as I told someone who asked me on Twitter earlier today, “I would wait to short $TSLA until after the pop settles & maybe the stock will start to crack. Not a short before tho, IMHO.” And not only that, but come on, why are taxpayers giving so much welfare to this one company? $6,000 welfare checks for people rich enough to spend more than $100,000 on their electric car? Sigh.

Why it makes sense to sell Apple and buy Google – I personally think it was a better time to be loading up on Google vs. Apple was probably when Apple was at all-time highs and Google was still far under their own 2007 highs. The trend is certainly on this guy’s side for now though.

93% of advisers had PTSD after 2008 – From the article, “To meet the criteria for a clinical diagnosis of post-traumatic stress, people must exhibit disturbances like the inability to sleep or concentrate at work for more than a month.” I’m sorry, and seriously, I know the crash was awful and tough. But most advisers work at banks that got bailed out. The millions who have lost their jobs and their homes, many through bank malfeasance, didn’t get bailed out. But their bankers are the ones we’re reporting as suffering from PTSD? Soldiers returning from the Republican/Democrat Wars in the Middle East and people who are directly exposed to terrorist attacks have PTSD. Focusing on PTSD suffered by somebody whose financial job exposing them to financial cycles is a mistake when there are so many soldiers going without the care we promised them.

Barnes & Noble soars on Nook rumor - Last time BKS soared on a Microsoft Nook headline, I wrote about what a great short trade opportunity it was to sell BKS into the pop. The stock dropped back in half after that MSFT Nook pop last time. It’s now close to being back to where it was at the top last time. I would look to short this thing again while it’s above $20 and if it gets above $25 it might be time to bet against BKS in size.

Is The Labor Market Really Improving? - What do you think? Again, don’t forget to take our poll - Poll - How is economy you deal with every day doing?

Cody Willard writes Revolution Investing for MarketWatch and posts the trades from his personal account at TradingWithCody.com, which is not affiliated with MarketWatch. At time of publication, Cody was net long Apple and Google and net short JPM. Follow Cody on Twitter at twitter.com/codywillard.

+0.76%

+0.76% +0.00%

+0.00% +2.12%

+2.12%