I wrote the following on August 21st, 2009:

-==-=-=-==-=-=-=-==-=-=-=-=-=-==-=-==-=-=-=-==-=-==-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-

This piece is one of my experiments where I try to straddle two different investment worlds in an effort to bring more understanding. The two world are stable value funds and commodity ETFs.

Commodity ETFs have a hard job, in that they are supposed to replicate the returns on spot commodities. Given the difficulty of storage, only a few commodities — gold and silver, can be physically stored — they don’t deteriorate. Unlike government promises, they are uniquely suitable for being money. (Sorry, had to say that.)

Other commodities require futures markets or off-exchange markets where swaps get traded. The swaps introduce counterparty risk, which is a common risk in many currency and commodity-linked funds. I’ve written about that before, along with criticisms of exchange-traded notes.

One of the problems that some commodity open-end funds and ETFs run into is that their investment strategy is too simple. “Buy the front month futures contract, and roll to the second month contract before the front month expires.” Nice, it should replicate holding the commodity itself, until a large amount of money starts to do it, and other investors recognize what a slave the funds are to their strategy.

So, what do the other investors do? They take the opposite side of the trade early, in order to make it more expensive to do the roll. Buy the second month contract, and short the first. As the first gets close to maturity, cover the first, sell and then short the second, and go long the third month contract. What a recipe to extract value out of the poor shlubs who buy into a commodity fund in order to get performance equivalent to the spot market.

Compounding Money Slowly

If you want to keep your money safe, and earn a little bit, what should you do? Invest in a money market fund. “Wait a minute,” some intrepid investor would say, “I can do better than that. I don’t need all of my money for immediate liquidity. I can ladder my funds out over a longer period. I can invest surplus funds out to the end of my period, and earn a better yield, and over time, my funds will mature bit by bit. I will have liquidity in a regular basis, and I will get a higher yield because yield curves slope up on average.”

Leaving aside the wrap agreements that a stable value fund buys, stable value funds build a bond ladder with and average maturity of 1.0 to 4.5 years. Commonly, it averages around 2.0 years.

The funds could invest everything short and give up yield. That would give them certainty, but lose yield. That is what the commodity funds are doing.

What could go wrong? There could be a large demand to withdraw funds when longer-dated contracts are priced below amortized cost, and the fund might not be able to meet all withdrawal requests. So far that has not happened with stable value funds.

The Fusion Solution

Whether in war or in business, it is not wise to be too predictable; opponents will take advantage of you. In this particular example, I would urge commodity funds to look at their liquidity needs over the next month, and leave an amount maturing in the next three months equal to 4-6x that amount. Then spread the remainder of funds according to advantage, looking at the tradeoff of time into the future versus yield of the futures contracts versus spot. Longer dated futures do not move as tightly with the spot markets, but they often offer more yield.

Ideally, a commodity fund ends up looking like a bond ladder, and as excess funds mature, they don’t get invested in the new front month contract, instead, they get invested in the longer dated contracts, near the end of the ladder, as a stable value fund would do.

This maximizes returns for the bond/stable value funds, and I believe it would work for commodity funds as well. Please pass this on to those who might benefit from it.

A Closing Aside:

Back in the late 90s, I ran one of my interest rate models to try to determine what the best investment strategy would be. I found that the humble bond ladder was almost always the second best strategy, regardless of the scenario, because it was always throwing off cash that could be reinvested out to the end of the ladder.

Again, please pass this along, and commodity fund managers that don’t get this, please e-mail me. I will help you.

-=-==-=-=-=-=-==-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-==-=-=-

Back to the present: this was prescient. As commodity ETFs got killed by rolling the front month, where they were front-run by hedge funds, a number of commodity ETFs moved to a method similar to what I proposed. Using an analogy from Stable Value Funds works, and now investors benefit from more intelligent liability structure inside their funds.

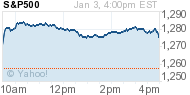

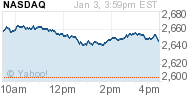

+0.17%

+0.17% +0.97%

+0.97% -1.07%

-1.07%