Here’s my take on the markets today, November 26th, 2012. If you’d like to read more of my articles, click here.

Credit gauges are mostly deteriorating today. The TED Spread is down -2.2% to 22.0 bps and the 2Y Swap Spread is falling -5.0% to 13.25 bps. However, the 3M EUR/USD Cross-Currency Basis Swap is down -2.6% to -27.9 bps. The European Investment Grade CDS Index is up +3.0% to 124.97 bps. The European Financial Sector CDS Index is gaining +3.5% to 166.08 bps. The Germany sovereign cds is up +3.8% to 31.67 bps and the France sovereign cds is gaining +2.0% to 87.17 bps. The Spain 10Y Yld is gaining +.1% to 5.62% and the Italian/German 10Y Yld Spread is rising +.8% to 334.14 bps. The Brazil sovereign cds is up +2.6% to 106.50 bps. The Israel sovereign cds is gaining +2.9% to 155.04 bps. Overall, credit gauges improved meaningfully last week, but remain at stressed levels.

Major Asian indices were mixed overnight as a +1.1% gain in Taiwan was offset by a -.5% decline in China. The Shanghai Comp sat out last week’s global equity rally, despite all of the bullish talk surrounding a potential rebound in economic growth, and continues to trade very poorly(-15.4% since 2/27) as it hovers just above the psychologically important 2,000 level. The Nikkei rose +.25%(+8.4% in 2 weeks). Puts on the Japan Index Fund(EWJ) fell to a 7-year low recently, according to Bloomberg, as the ETF approaches serious technical resistance and is overbought on stimulus speculation. I still think Japan will underperform other major developed markets over the intermediate-term despite attempts to weaken the yen and more stimulus. Major European indices are lower today, weighed down by a -.9% decline in France. The Bloomberg European Bank/Financial Services Index is falling -1.2%. Brazil is down -1.2% and continues to trade very poorly(-17.1% since 3/14).

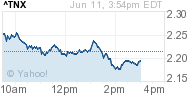

The euro is pulling back -.2% and is in the middle of the range it has been in since Sept. Oil (-.5%) and Copper (+.2%) continue to trade very poorly considering the potential upside catalysts that are currently being ignored. Lumber (+.2%) continues to consolidate recent gains in a healthy fashion. The benchmark China Iron-Ore Spot Index is falling -.6%(-3.7% in 5 days) and is down -34.7% since 9/7/11. Gold is flat and is consolidating recent gains just above its 50-day in a healthy fashion. The UBS-Bloomberg Ag Spot Index (+.3%) is stabilizing, after recent losses, just above its 200-day. The 10Y T-Note continues to trade too well with the yield falling -3 bps to 1.66%, which remains a big red flag.

I continue to believe that anything other than a US fiscal cliff can-kicking or small deal is unlikely, which will still leave significant uncertainty for investors, businesses and consumers over the coming months. Key European economies continue to weaken and I still believe their debt crisis will resurface again next year in an even more intense fashion. As well, Mideast tensions continue to escalate and will likely boil over again in the first half of next year.

The major averages are rallying off morning lows into the afternoon. Given the still significant and developing macro headwinds and last week’s strong advance, investor complacency appears fairly high again. Transport, Utility and Tech shares are holding up relatively well today. Healthcare, Consumer Discretionary, Energy and Mining shares are weak. I have not traded today and I am still 50% net long.

+0.00%

+0.00% +0.06%

+0.06% +1.21%

+1.21%