Let’s run through some big and/or important (not the same thing!) headlines today. One of the keys to successful long-term investing is to look past what others are seeing in the news and staying as objective as you can while you do so.

How Twitter is becoming your first source of investment news — My old friend and colleague Barry Ritholtz is ahead of the trends. I use twitter increasingly every day for stock and market news and ideas. You can follow me on twitter at http://twitter.com/codywillard.

Stocks: Apple, Amazon, Netflix earnings on tap — Big earnings reports ahead. Apple’s out with earnings tomorrow after the market closes. I haven’t seen a bullish article in the press though I did hear a bullish analyst who upgraded the stock this morning. He was sort of a goofball on the show though and really seemed to have little insight or value add, so there’s that. Anyway, I sure would rather be long than short AAPL into the earnings call tomorrow, if for no other reason than the fact that the bar has been set so low and expectations are for a big miss and lower guidance. That might all already be priced in at the 7 p/e it’s trading at.

Indicator Update: Interpreting Mixed Signals — The Felix Indicator, from my old friend and master trader, Jeff Miller, throws up some mixed signals of its own. Find out what the still-on-fire Felix Indicator says will happen to the markets next.

John Hussman: The Endgame Is Forced Liquidation — A look back and a very insightful chart of past “Still Bullish” Barron’s magazine covers. I wouldn’t trade off the Barron’s cover contrarian indicator, but I bet at some point in the next 10 years, we’ll be back below the current stock prices and this will be a new addition to the chart.

Restyled as real-estate-trusts, varied businesses avoid taxes – These companies that explicitly rely on tax code arbitrage and shifting their ownership style are almost always great shorts at some point. Make note of the companies mentioned in this column. Most will be bankrupt and restyled yet again at some point in the next decade.

Madison Montana’s Maximum Velocity Trading Room – Madison, the hottest trader I know right now, nailed the IBM, EBAY and GS shorts into their earnings reports last week (I was also and am still short IBM and GS). Marketwatch readers get to see what she’s trading this month for free on WallStreetAllStars.com.

Local News Anchor Fired On His First Day After Accidentally Swearing On Live TV – I feel for him. I’ve accidentally cussed (& worse) on TV but it wasn’t my first day. TV is a dying medium anyway.

Maine farmers speak out against local food sovereignty movement — I added Lindsay LNN as a great play on the local vs. global food and water dynamic. I am likely to hold this one and probably find another stock or two to profit of this trend in future years.

Anti-frackers score victory on upstate NY home front… Town of Sanford board forced to repeal fracking gag law – The victory for the anti-frackers is simply that they can exercise their right to free speech. That’s not much of a victory. Water remains a very constrained commodity and LNN is also a great play on that concept.

No light at end of tunnel yet for euro zone – The question is when, not if, those panicky EU-crisis headlines return. They certainly haven’t solved them.

Never toss out a tax return – Good article though it means that hoarders have an excuse to keep those tax returns forever. Sigh.

Time to buy gold, any way you can - I’m also continuing to hold the GLD that I mentioned here in this column last week, as I think we will see this near-term bounce back continue and I expect that bounce back will continue to be reflected in the GLD quote for at least the near-term. I reiterate and that huge premium in the silver coin market over spot price continues to indicate that you can’t trust the GLD or any other paper asset in the long run.

Cody Willard writes Revolution Investing for MarketWatch and posts the trades from his personal account at TradingWithCody.com, which is not affiliated with MarketWatch. At time of publication, Cody was net long Apple, gold, Lindsay and Amazon and net short IBM and Goldman. Follow Cody on Twitter at twitter.com/codywillard.

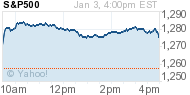

+1.05%

+1.05% +1.14%

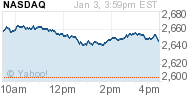

+1.14% +7.42%

+7.42%