The economic news for the first quarter of 2013 has been mixed, with several confusing factors. Income was pulled ahead into late 2012 in anticipation of tax policy changes, some of which did not occur. The end of the payroll tax reduction has been expected to reduce consumption for the average family, but those effects did not seem to show up until March. There have been similar mixed signals from China. Each quarter’s earnings reports provide a different and important addition to the economic data.

What will be the message from this earnings season?

This quarter follows the usual pattern. Expectations have been reduced for most companies and for the S&P 500 as a whole. This means that the “beat rate” will be over 60%. Officially the expectations call for virtually no increase over Q112. In practice, most observers expect growth of about 4%.

In sharp contrast, the forward earnings estimates are close to an all-time high — as is the stock market. While some focus on trying to tweak the average earnings over the last ten years, others are looking ahead. While the latter group seems to have prevailed, that is a superficial analysis. The forward earnings yield is currently 7.25%. This level provides room for a lot of skepticism about stock prices.

Most popular sources do not quote data about forward earnings for the market, although it is common parlance for individual stocks. This distinction makes no sense, as I suggested in this post. The forward earnings data are almost like having inside information. You can get the scoop legally from Brian Gilmartin, who is rapidly becoming a go-to source for earnings forecasts.

I have some thoughts which I’ll report in the conclusion. First, let us do our regular update of last week’s news and data.

Background on “Weighing the Week Ahead”

There are many good lists of upcoming events. One source I regularly follow is the weekly calendar from Investing.com. For best results you need to select the date range from the calendar displayed on the site. You will be rewarded with a comprehensive list of data and events from all over the world. It takes a little practice, but it is worth it.

In contrast, I highlight a smaller group of events. My theme is an expert guess about what we will be watching on TV and reading in the mainstream media. It is a focus on what I think is important for my trading and client portfolios.

This is unlike my other articles at “A Dash” where I develop a focused, logical argument with supporting data on a single theme. Here I am simply sharing my conclusions. Sometimes these are topics that I have already written about, and others are on my agenda. I am putting the news in context.

Readers often disagree with my conclusions. Do not be bashful. Join in and comment about what we should expect in the days ahead. This weekly piece emphasizes my opinions about what is really important and how to put the news in context. I have had great success with my approach, but feel free to disagree. That is what makes a market!

Last Week’s Data

Each week I break down events into good and bad. Often there is “ugly” and on rare occasion something really good. My working definition of “good” has two components:

- The news is market-friendly. Our personal policy preferences are not relevant for this test. And especially — no politics.

- It is better than expectations.

The Good

This was a generally negative week, but there were a few bright spots.

- Market action breaks out of the trading range. See Charles Kirk’s weekly chart show (modest membership fee required) for his typically excellent analysis. His readers learn to be flexible, changing with the evidence.

- Initial jobless claims were better than expected and back to the recent range. It appears that seasonal effects were an influence, as we noted last week.

- Bullish sentiment declines. This is bullish (see Phil Pearlman) on a contrarian basis, as noted by Bespoke:

-

The federal deficit is declining as a percentage of GDP. Those who are confusing political rhetoric with investment decisions should take two minutes to read the entire Calculated Risk post. For those who cannot spare the time, here is the conclusion:

It shocks people when I tell them the deficit as a percent of GDP is already close to being cut in half (this doesn’t seem to ever make headlines). As Hatzius notes, the deficit is currently running under half the peak of the fiscal 2009 budget and will probably decline further over the next few years with no additional policy changes.

- Housing inventory declines 15% year-over-year. (Via Calculated Risk).

The Bad

The important economic news was mostly negative this week.

-

QE may be ending this year, if the Fed minutes are a guide. Fed watcher par excellence Tim Duy (FOMC Minutes Signal End to QE) draws that conclusion. I am scoring this as “bad” because that is the market reaction. Tim (with whom I discussed this and also the effects of the QE end at the Kauffman conference) suggests an important change in our attitude about this, writing as follows:

Bottom Line: The Fed seems content with the current pace of activity. Content enough to believe they can pull the plug on quantitative easing this year. I remain concerned that ending QE will slow forward momentum, thus the Fed is running the risk that they the economy will not achieve sufficient velocity to escape the zero bound. The actual timing is still data dependent, but I am wondering if we should change our framework from “how good does the data need to be end QE” to “how bad does the data need to be to continue QE?”

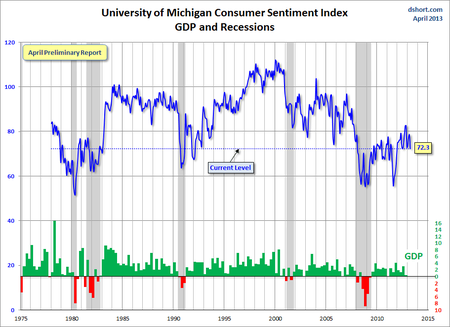

- Michigan consumer sentiment tanked to 72.3 from last month’s 78.6. I give this series more significance than many of my blogging colleagues, and not just because it is my school. It has a good record of correlation with employment growth. Perhaps there will be a rebound in the final report, just as we saw last month. Doug Short has a great discussion of this series and a typically informative chart:

-

Retail sales declined 0.4%, the worst report since June, 2012. This is no surprise for those concerned about the effects of the resumption of normal payroll tax rates. Doug Short sees the consumer behavior continuing at a “recessionary level.” Bonddad opines that this is partly a gasoline price effect.

The Ugly

Bitcoin! Check out Joe Weisenthal’s crash analysis and chart. For a comprehensive analysis and many great links, see Cody Willard’s continuing coverage.

Here is a key quote:

Bitcoin is a Ponzi Scheme: The Internet Currency Will Collapse – Most serious investors and traders (including my colleagues in the WallStreetAllStars.com Platinum Chat Room — free this month for Marketwatch readers) are writing Bitcoin off as a bubble or a scam. I’m leery that this first attempt at a global private currency is not well-enough protected and centralized. But to write off the whole idea is to miss an incredibly important economic development of our time.

The Indicator Snapshot

It is important to keep the current news in perspective. My weekly snapshot includes the most important summary indicators:

- The St. Louis Financial Stress Index.

- The key measures from our “Felix” ETF model.

- An updated analysis of recession probability.

Anyone who has followed these objective indicators over the last two years has had a significant advantage in trading and investing. Each has contributed to the result. Here is how.

The St. Louis Financial Stress Index

The SLFSI reports with a one-week lag. This means that the reported values do not include last week’s market action. The SLFSI has moved a lot lower, and is now out of the trigger range of my pre-determined risk alarm. This is an excellent tool for managing risk objectively, and it has suggested the need for more caution. Before implementing this indicator our team did extensive research, discovering a “warning range” that deserves respect. We identified a reading of 1.1 or higher as a place to consider reducing positions.

The SLFSI is not a market-timing tool, since it does not attempt to predict how people will interpret events. It uses data, mostly from credit markets, to reach an objective risk assessment. The biggest profits come from going all-in when risk is high on this indicator, but so do the biggest losses.

Recession Forecasting

The C-Score is a weekly interpretation of the best recession indicator I found, Bob Dieli’s “aggregate spread.“ I have now added a series of videos, where Dr. Dieli explains the rationale for his indicator and how it applied in each recession since the 50′s. I have organized this so that you can pick a particular recession and see the discussion for that case. Those who are skeptics about the method should start by reviewing the video for that recession. Anyone who spends some time with this will learn a great deal about the history of recessions from a veteran observer.

I have promised another installment on how I use Bob’s information to improve investing. I hope to have that soon. Anyone watching the videos will quickly learn that the aggregate spread (and the C Score) provides an early warning. Bob also has a collection of coincident indicators and is always questioning his own methods.

I feature RecessionAlert, which combines a variety of different methods, including the ECRI, in developing a Super Index. They offer a free sample report. Anyone following them over the last year would have had useful and profitable guidance on the economy. Dwaine Van Vuuren has a regular report that “scoops” the ECRI’s WLI announcement with amazing accuracy. Dwaine also does a useful world economic review with a country-by-country analysis of the improving global recession status. Essential reading!

Georg Vrba is a great “quant guy” with an excellent variety of useful tools, some available via a free subscription. His take on a possible recession? Based upon unemployment data, the ECRI is wrong.

Doug Short has excellent continuing coverageof the ECRI recession prediction, now eighteen months old. Doug updates all of the official indicators used by the NBER and also has a helpful list of articles about recession forecasting. Doug also continues to refresh the best chart update of the major indicators used by the NBER in recession dating — now reflecting the most recent data. Here is Doug’s latest opinion on the ECRI forecast:

Despite my rejection of ECRI’s call that a recession began in mid-2012, I do think the US economy remains vulnerable. The greatest endogenous threats are disappointing Personal Income data (not helped by the expiration of the 2% FICA tax cut) and the real impact of sequestration, which has scarcely begun. Today’s weak Advance Retail Sales Report does not bode well. Exogenous risks include a recessionary eurozone, war mongering in North Korea and potential destabilizing of world economies by aggressive monetary policies.

Readers might also want to review my Recession Resource Page, which explains many of the concepts people get wrong.

Our “Felix” model is the basis for our “official” vote in the weekly Ticker Sense Blogger Sentiment Poll. We have a long public record for these positions. About a month ago we switched to a bullish position. These are one-month forecasts for the poll, but Felix has a three-week horizon. Felix’s ratings stabilized at a low level. The penalty box percentage measures our confidence in the forecast. A high rating means that most ETFs are in the penalty box, so we have less confidence in the overall ratings. That measure remains elevated, so we have less confidence in short-term trading.

[For more on the penalty box see this article. For more on the system ratings, you can write to etf at newarc dot com for our free report package or to be added to the (free) weekly ETF email list. You can also write personally to me with questions or comments, and I'll do my best to answer.]

The Week Ahead

The coming week includes plenty of news from many sources.

The “A List” includes the following:

- Chinese economic reports (M). Even before the trading week starts in the U.S., we’ll see data on China’s GDP, industrial production, and retail sales. This has great importance for world economic estimates and many international companies. [Pre-publication update from Joe Weisenthal (whom I finally got to meet in person at Kauffman). Joe puts in the longest day of anyone, covering everything. The reports are a bit light.]

- Initial jobless claims (Th). Employment will continue as the focal point in evaluating the economy, and this is the most responsive indicator. Special interest after the gyrations of the last two weeks.

- Building permits and housing starts (T). Optimists on the economy point to housing. The Permits report is a good leading indicator.

- Industrial production (T). Closely followed by those with recession fears.

The “B List” includes the following:

- Leading economic indicators (Th). Expected to hover near zero.

- Philly Fed (Th). Promoted in significance this month because of the attention to a possible March turning point.

- CPI (T). Inflation data will become more important when there is some sign of actual price increases.

- The beige book. (W). Anecdotal evidence by region for the Fed to keep in mind at the next meeting.

Speeches by Fed members – several of them – stretching throughout the week.

And most importantly of all: earnings, earnings, earnings.

Trading Time Frame

Felix has continued a bullish posture, and the ratings have stabilized. There are more solid candidates to buy, although the preferred sectors are pretty conservative. We resumed a fully invested posture in trading accounts (up from 2/3 long) early last week. This was a surprising shift in the overall ratings.

Investor Time Frame

Each week I think about the market from the perspective of different participants. The right move often depends upon your time frame and risk tolerance.

Buying in times of fear is easy to say, but so difficult to implement. Almost everyone I talk with wants to out-guess the market. The problem? Value is more readily determined than price! Individual investors too frequently try to imitate traders, guessing whether to be “all in” or “all out.”

Investors who have been underinvested in stocks wonder if it is too late to invest. Those who have enjoyed the current rally are bombarded with warnings about the need to sell. This is especially true in the spring, where the misperception is that stocks usually decline. (Actually, the rate of growth is slower). The Charles Schwab team published a good analysis of spring weakness over the last two years, including this chart:

Are we in for a repeat performance in 2013?

It’s possible, but if so, it’s likely to be less severe than the past few years. First, trying to time such a potential event is not recommended. With hindsight being 20/20, investors would had to have known to sell in April of the past three years (not quite the traditional “sell in May” mantra) after a nice start, while also knowing to buy back in July, August, and June, respectively to take advantage of the gains seen during the rest of each year—much earlier than the traditional fall time frame often cited as the best time to return to the market. This illustrates the folly of trying to time the market, although we do suggest investors who are nervous look into some simple hedging strategies that may help to limit losses in the event of a near-term pullback.

This is a helpful analysis. Investors should take what the market is giving them. This includes both finding bargains among the laggards and selling short-term calls against reasonably-priced dividend stocks. We are actively pursuing both of these strategies. Investors who want to do the necessary work can imitate these strategies.

We have collected some of our recent recommendations in a new investor resource page — a starting point for the long-term investor. (Comments and suggestions welcome. I am trying to be helpful and I love feedback).

Final Thought

The current earnings season has a special significance. It will not be easy to interpret, since the economic data weakened during the quarter. This was apparent in the reaction to earnings from last week. Here are the key things to watch:

- Whether the EPS beat estimates – still important, but less so. Think of it as a necessary, but not sufficient condition for stock appreciation.

- Revenue beating estimates. This addresses the concern about declining margins and beating earnings only through cutting costs (which has a limit).

- Quality of earnings. The market will be skeptical of any company that “beats” estimates through a method that smacks of accounting gimmicks.

- Outlook. Companies have little incentive to “talk up” the future, but conference call questions will probe the outlook.

- Change throughout the quarter. This is especially important given the mix of policy changes in Q1.

These factors are always important, but especially so right now. When the market is reaching new highs, there are many skeptics.

I plan to exercise caution on individual stocks during this earnings season.

Related posts:

[...] Indicator Update: A Critical Season for Earnings — Jeff Miller’s Felix system is still just on fire and I can’t wait to see what he says about this gold crash in his column tomorrow. Here’s his preview of the week and it’s got currency and precious metal info you need. [...]