I am glad I began investing 20+ years ago. If I were considering starting now, I would likely not do it. Why?

1) Too much data. There are too many factors to consider in investing. That there is a wealth of data to consider is certain, but what are the right factors to look at?

2) Crowded. More people and firms are investing. The competition is higher.

3) There are more games in trading. Makes it a lot harder to get good executions. The low costs of transaction have created monsters.

4) ETFs affect the market as a whole. They allow average people to speculate on broad trends, without telling most of them that they are noise traders, and are getting taken for a ride. Dollar-weighted returns are far less than that for buy-and-holders in ETFs. The traders are getting creamed.

5) Social media leads to groupthink, which lowers overall returns, at least for those that get there late.

6) ETFs allow investors to play well outside their circle of competence. Beyond that, some ETFs don’t always do what they promise because of the derivatives that they use, roll, etc.

7) We are in a macroeconomic environment where we are delevering. That is not the best environment for making money.

In general, I think most individual investors are cows for the institutions to milk. But there are a few ways to immunize yourself from this:

a) Hold very short or very long. I lean toward the latter. Don’t give up quickly on your investment ideas. Buy and hold for years, not months. Ignore the chatter, and read the data from the company and trusted third parties.

b) Use a value bias, and focus on companies where there is a margin of safety. Buy the shares of companies with lesser growth prospects, that are selling cheaply. Who cares if earnings aren’t growing if the earnings yield is over 15%.

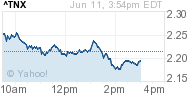

+0.76%

+0.76% +0.00%

+0.00% +2.12%

+2.12%