One of the many reasons that individual investors are scared witless (TM euphemism by OldProf) is a complete misunderstanding of the role of central banks and a distortion of current policies.

The critics of the Fed — and now the ECB and other European banks — have an easy path to page views and affirmation by readers who never took the class in Money and Banking.

This has the usual result. Anyone who is willing to spend a little time while keeping an open mind can gain a significant investment advantage.

The Current Scare

Let us begin by summarizing the story that I hear from so many people through comments, emails, or calls. It runs something like this:

- The Fed is printing money with reckless abandon.

- Other Central banks are now doing the same.

- Bank balance sheets are exploding and have huge leverage ratios.

- Gains in equity markets are a “sugar high.”

- Central banks could be wiped out with the smallest downturn.

- Or if forced to unwind these trades, stocks would collapse.

A Typical Argument

Perhaps the most prestigious of those making such arguments is Jim Bianco. Since he is regularly featured on CNBC, has his work published at Barry Ritholtz’s blog, and has institutional clients, everyone takes his research output quite seriously.

His recent piece at The Big Picture touched all of the bases described above, and also threw in a comparison of balance sheets with aggregate stock market values. I am going to stick to the Fed balance sheet in this analysis, but it should illustrate the point.

Here is the chart of the Fed balance sheet provided by Bianco.

This chart repeats many of the errors from the Michael Pento arguments that I refuted here. If Bianco had read this research, his article might have been stronger.

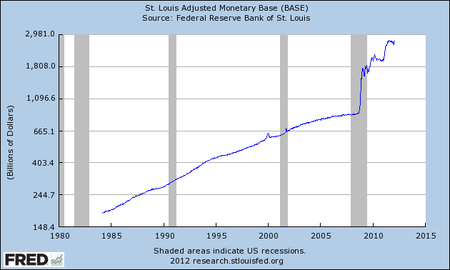

To start with, long-term data series should be described on a log scale. This means that a proportional change is constant over time. Let’s look at the Fed’s monetary base.

This better demonstrates the recession response as well as QE II. It also makes clear that everything else is irrelevant.

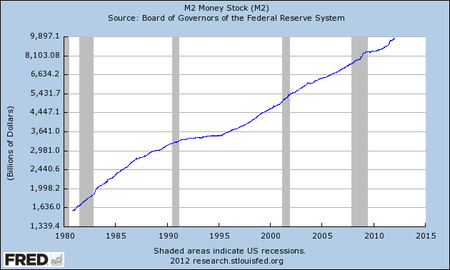

The most crucial thing to understand is that the balance sheet does not represent “printing money.” This happens when reserves are created for participating banks and they make additional loans. This has not been happening. Essentially, the Fed has stepped in to (temporarily) take up the slack in the money supply. Disciples of Milton Friedman know that the long-term money supply is aligned with nominal GDP growth, so money creation is important.

To emphasize: Printing money is necessary and appropriate — at the right pace.

The question is whether the growth in M2 has been excessive. Here is the key chart. As you can see, the long-term growth looks pretty reasonable.

The Conference Board (and I suspect the ECRI) have dropped M2 from their indicator series since the modest result described above is apparently too bullish.

Conclusion

The Bianco analysis is another example of Wall Street Truthiness. Since so many are primed to hate the Fed, the ECB, and the entire concept of central banking, it is popular for many to rant on this every day.

The comparison of central bank holdings with equity markets is an egregious blunder. There is absolutely no reason to compare debt holdings with anything other than the debt market. I have frequently analyzed the Fed purchases of debt and shown these to be a modest fraction of the trading volume in Treasuries. Experts estimate the impact on yields to be modest.

When and if the time comes to unwind these positions, it will have little long-term effect on either bond or stock markets. I explained this in several past articles, but the most important is here.

This is an interesting choice for investors. Most of them cannot really grasp the money and banking aspects of money creation. It is a pretty tricky concept.

This makes it prime fodder for those who want to fool you by calling the balance sheet “printing money” when that is not correct.

There is so much mis-information and so little time.

I am now told by an investor that the GDP increase of 2.8% proves that the ECRI recession forecast is correct.

Wow!

Related posts:

-0.69%

-0.69% -0.80%

-0.80%