Much of our growth the last 3 decades was debt fueled. That clip has been emptied, no bullets are left. Quite simply, total leverage in the economic system is too much to be supported by cash flows/earnings of the system participants. There needs to be a massive reliquification/delivering. Yet the global central banks refuse to allow that to proceed.

My best guess is that that we will resist a reliquification at all cost, and until the financial system as we know it collapses from the weight of the debt and printed money. When that happens is anyone’s guess, but I think it occurs within the next few years. This disorderly delivering will become the Great Reset and contain much debt/liability write-downs which will deflate asset prices across the board.

The best thing going for stock holders is the fact that corporations are the only true AAA credits. And, companies especially here in the US, have shown a willingness to ruthlessly protect profit margins at the expense of labor. So they will be the survivors of this process and should capture any inflationary pressures from debt monetization in their pricing and profitability. Before it’s over, stocks could easily be the safe haven trade. We are seeing signs of that now, IMHO.

Understand the implications of this chart, and you realize the old normal was not so much. It was an epic binge of pull forward of consumption/investment, that’s what excess debt growth represents. And you also understand that a massive markdown in debt must occur, in either an orderly or disorderly manner. There will be no solution without some financial pain. More debt does not fix a problem of insolvency, and that’s the issue we refuse to acknowledge.

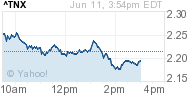

+0.27%

+0.27% +0.41%

+0.41% +2.24%

+2.24%