Here’s the transcript for Platinum Chat for March 29, 2012. You can check out the Chat Room live anytime at wallstreetallstars.com/platinum-chat-room.

March 29, 2025 - 8:22 am

Would it be ironic if the top of the market this year coincide with the debut of the movie “Hunger Game”? In fact, Lions Gate is already down 20% since last week.

March 29, 2025 - 8:32 am

lol… very good sonny

while rhino is right, there is a tenacious bid on dips, every dip results in more technical damage to the market’s breadth. The same thing happened last spring. Sectors rolled one by one but indices held up as investors piled into mo-moand defensive favs. When that ended stocks hit massive air pocket in summer. While indices holding up, many industries breaking down now. Some important technical divergences emerging. We may still be in buy dip mode, but trend clearly not as healthy as fat part of rally.

Bob and bears win this one today. Selling is heavier and oil/banks under pressure. Not good. Let it play out.

Permabid TRYING to step in here-think it fails today.

March 29, 2025 - 10:09 am

@rhino31: Today is not relevant - the penultimate trading session in the quarter. People are just adjusting their positions. Why would anyone with cash want to or need to add before the quarter end?

March 29, 2025 - 10:25 am

@Scott: window dressing: to show they’ve been invested and not sitting on too much cash

Scott-was talking specifically about trying to trade it intraday based on the pattern we’ve seen over and over for the past few months. Normally I would step in and try to play the pattern of weak opens, followed by intraday rally. Was only pointing out that I wouldn’t do that today. Did you just switch to decaf today?

March 29, 2025 - 10:28 am

lol Scotty

March 29, 2025 - 10:36 am

Scott, but Europe are in red, Italy 3% down. considering that , ….we are strong today with the help of the supports in the S&P and DJI. We do not have much room to go down….

giorgio-we’ve had a monster rally into Q end. We’ve got a TON of room to go down. I don’t think we will, but don’t kid yourself.

March 29, 2025 - 10:37 am

the UUP at 22 and a sell off on china are the problems

March 29, 2025 - 12:30 pm

This is my pair trade going into year-end: short iOS and long Windows 8. That means you short AAPL and long MSFT, INTC, STX, WDC.

March 29, 2025 - 1:40 pm

big ones, SB

March 29, 2025 - 1:40 pm

lol

March 29, 2025 - 1:42 pm

i think that’s jay’s way of saying …

It wouldn’t be a bad idea, except all those other names are just as overbought/extended as AAPL. Id rather doe the long GOOG short AAPL

March 29, 2025 - 1:57 pm

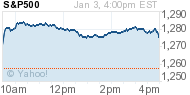

As I thought, 1,400 is a magnet for expiration tomorrow

March 29, 2025 - 2:01 pm

This explains why we will have a big bull market all the way till November. Have you seen what Obama and France’s Sarkozy did to the oil market this week? Wait till China cutting rate tonight! http://www.gfmag.com/archives/148-march-2012/11618-cover-story-global-elections-2012.html#axzz1qX8sURyl

scott-I’d like to add to ARCO. Would you wait? Technicals point to a bit lower price. Looking to back in around 17.5 area.

March 29, 2025 - 2:26 pm

@rhino31: cant answer as to the technicals. Stock seems to be hated which makes me like it more. Long ARCO

Thanks-just added a few nov 17.5′s

Mark it down-china cuts this weekend. All the crappy metal stocks rallying today. Heck, even VALE is up!

crappy coal stocks up too

March 29, 2025 - 2:58 pm

@scott: I don’t know much about options, since I can’t trade them (covered options only in IRAs). The option chain says there are calls at 1405 and 1410 on the SPX as well as 1400. Is there a reason why 1400 is more appealing as a strike than 1400?

March 29, 2025 - 3:06 pm

@AlanHHI: largest open interest at the 1400 strike price

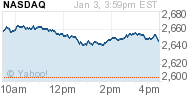

perma bid still there. bulls won again. bears pulling hair out.

+0.37%

+0.37% +0.00%

+0.00%