WallStreetAllStars.com is proud to present Jordan Kahn’s “Get Mental!” Investor Psyche Diary.

Each trading day in the “Get Mental!” Investor Psyche Diary, Jordan focuses on investor sentiment and a bevy of indicators he follows, marrying his stock picks and opinions with technical analysis. Jordan gives special attention to the concept of investor psychology, something that is sorely missing from most people’s arsenal.

For a limited time, Jordan Kahn’s “Get Mental!” Investor Psyche Diary is open to the public, but in a few weeks, you’ll need to be a WallStreetAllStars.com Platinum subscriber to continue your education.

——

WallStreetAllStars.com is a revolutionary financial news hub featuring original trading ideas and portfolio strategies from the best money managers, traders, pundits and financial reporters on the Internet. A Platinum account gets you full access to every article and feature on the site and allows you to connect to some of our best writers in real-time. (Learn more)

Jordan Kahn, CFA, is the President and CIO of KAM Advisors a Beverly Hills-based money manager and is the author of Jordan Kahn’s “Get Mental!” Investor Psyche Diary. He previously was a managing partner with Beverly Investment Advisors. Mr. Kahn holds a master’s in financial markets and trading from the Stuart School of Business at the Illinois Institute of Technology and a bachelor’s degree in economics and finance from the University of Colorado.

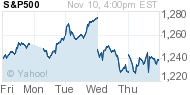

+2.07%

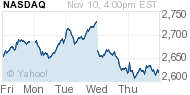

+2.07% +2.15%

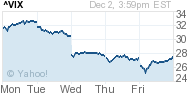

+2.15% -7.83%

-7.83% Print

Print