The market pulled back in early trading this morning but the dip proved brief as the indexes have already started to climb back into positive territory. The major indexes are poised for more new highs, and the S&P 500 approaches the 1600 level.

Normally you would expect investor enthusiasm to be reaching very high levels with the market rallying like this, and speculation running rampant. But a recent look at several investor sentiment surveys reveals that is far from the case. Most of the surveys we track have showed more bears than bulls in the polls for the last few weeks. That is a very odd occurrence, and tells us that most investors don’t trust this rally.

Of course, the market would more likely to top if investor complacency was near its peak. But with optimism running somewhat low, it looks more like the market can keep climbing the proverbial ‘wall of worry’ in the near-term.

Economic data was solid this morning. The Case-Shiller home price index for February rose 9.3% on top of an 8.1% gain in the previous month. And March’s number is likely to be strong as well. The latest consumer confidence reading rose to 68.1 from 59.7 last month. And the Employment Cost Index cooled to 0.3% in Q1 from 0.5% last quarter.

Earnings season is still in high gear with roughly 100 companies reporting last night and this morning.

Stocks rising on earnings: ESRX, DDD, HIG, SU, AMG, DPZ, ECL, HCP, NEE, HOT

Stocks falling on earnings: FN, JEC, MAS, NEM, CMI, DBD, MPC, NUAN, PFE, BWLD

Asian markets were mostly higher overnight. China remained closed for a holiday. Taiwan’s GDP fell -0.8% last quarter. And the Bank of Korea governor said that the effectiveness of global quantitative easing policies is decreasing.

Europe’s markets are mostly lower today. German retail sales fell -2.8%. Italy’s unemployment remained at 11.5%, while Eurozone unemployment ticked higher to 12.1%.

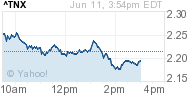

The 10-year yield is up slightly to 1.67%. And the VIX is basically flat at 13.75.

Trading comment: No change to recent comments about our strategy here. We continue to want to add selectively to equities by focusing on companies that reported solid earnings recently. We prefer not to bottom dip in stocks that recently disappointed and saw their stocks have big drops. More often those weak quarters persist into next quarter and the stocks continue to lag. We prefer to focus on those stocks that continue to lead the market. In Q1 that was mostly defensive type stocks, but we are on the lookout for more growth stocks to start to resume their leadership. AAPL is back above its 50-day average after strong demand for their debt offering which will fund their increased buyback and dividend strategy.

KAM Advisors has long positions in AAPL, ESRX, DDD, NEE, PFE

+1.05%

+1.05% +1.14%

+1.14% +7.42%

+7.42%