The markets started out of the gate on a weak note, but have already recouped most of their early losses. Overnight foreign markets were fairly weak, in addition to a weak close here for US markets yesterday. But some solid economic data led to some early dip buying.

The ISM Index for February came in better than expected at 54.2, its highest level since June 2011. Also, the Univ. of Mich. Consumer Sentiment survey for February rose to 77.6 from its previous reading of 76.3. So consumer sentiment has been bouncing in recent readings.

Asian markets were mostly lower overnight after the latest Chinese PMI reading declined to 50.1. That’s still above the 50 level that marks the line between expansion and contraction, but its the lowest reading since last September.

In Europe, markets are also lower led by a -2.2% decline in Italy. Italy’s PMI came in worse than expected at 45.8. The country’s debt-to-GDP ratio hit its highest levels in more than 20 years. The overall Eurozone PMI came in slightly ahead of consensus at 47.9 (still in contraction zone) and the Eurozone overall unemployment rate ticked up to 11.9%.

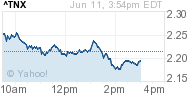

The 10-year yield is lower again to 1.85%, and not back below its 50-day average. The VIX is bouncing 2.8% back near the 16 level.

Trading comment: The first day of the month has seen gains in most recent months with new flows coming into equities. Today the market bounced from its early losses, but has been fading a bit since. It’s still early, but a weak close today would likely mean more choppiness and consolidation next week. March is a month often known for heightened volatility. So we want to continue to manage our risk closely. A further pullback in the market would likely offer a good opportunity to scale into market leading stocks that have been too extended to chase. Have a good weekend-

-1.43%

-1.43% +0.00%

+0.00% +1.88%

+1.88%