Here are some trading ideas for 2012:

Some people like buying stocks, like this penny stock trader and he’s had great success profiting sometimes $25,000 within just a few hours…

But contrary to widespread belief, as I posted the evidence the other day that the stock market is a scam, finding the best stocks in any one year is not about picking which companies will thrive the most — that’s a crapshoot as industries change too fast these days to have any clear longterm vision, as the terrible performance of longterm investors the past few years demonstrates — the best stocks in any one year comes down to finding the biggest scams and WORST companies…and short selling them whenever they spike.

This contrarian strategy made me a millionaire by age 22, its earned me 50%+ each of the past few years even as the stock market as a whole has been flat to down and I’m proud to say I am the single most hated blogger by smallcap companies, all of which I’ve achieved by age 30…not to mention this strategy has made my students millions of dollars in the past few years as evidenced by these 3 fine charts:

$1.7 million in TIMalert subscriber profits, the $1.5 million in PennyStocking Silver subscriber profits and the rapidly rising profits of my trading challenge students (check out their profit chart)

I’m sorry to pick on my ex-friend Chris Lahiji — yup, when you’re a short seller on the opposite side of the smallcap pumping world, no matter how much you like each other, friendships die quick deaths…and Chris shame on you, you should know better, you might be making $ now, but there’s no longterm business models in screwing over investors) — but each year he puts on the LDMicro conference featuring the absolute WORST smallcap and microcap companies most desperate to raise cash and gain exposure to get their stock prices higher ASAP so they can stay in business and pay their incompetent management teams.

(Before being exposed as scumbags for bringing a whole bunch of Chinese frauds exposure they never should have received and sending me a cease & desist letter which I responded to publicly and never heard from the snakes again, Red Chip used to throw annual conferences for these toxic companies…unfortunately people caught on after a few years as nearly all the companies at their conferences went bankrupt and their stocks dropped 99%+…LOL sad but true)

Each of the past 2 years I’ve posted HERE and HERE lists of Lahiji’s year-end conference companies and year in year out, these are the best stocks for the upcoming year…to short sell them…if and when they ever spike as any spike is sold into by the desperate shareholders/bagholders who have been in far too long and jump at the chance to exit these failures and the stock drop quickly, thus making them THE BEST STOCKS FOR 2012. ![]()

Despite taking message board heat from people dumber and poorer than TMcnasty (many of whom are paid promoters or employees of these carcass companies pretending to be investors attempting to lure other investors into these bottomless pits…yes if the SEC ever cleaned up online message boards, I’d estimate 75-95% of smallcap and microcap company executives would be busted), Lahiji’s conference lists are the single best resource available to create a watchlist to short sell.

Don’t believe me? 2009′s list NAILED a bunch of scams, bankruptcies and most importantly 90%+ stock drops, as did 2010′s list. Look at how some of the 2010 conference companies fared, if you go through the whole list, you’ll see this chart pattern again and again and again and remember I warned time and again HERE and HERE and HERE on stocks like CrowdGather Inc (CRWG) that have dropped 90%+ despite being featured by “professional blogger” Michael Arrington HERE…CRWG’s CEO declined a request by Mixergy’s Andrew Warner to publicly debate me as to whether or not his company is a blatant pump and dump…investors who didn’t believe me were forced to endure this chart in 2011:

I Was Right, Michael Arrington Is A Moron

I Was Right, Michael Arrington Is A Moron

The CRWG Crow chart (a reference to the chart pattern explained in depth in my original PennyStocking DVD) is not unique among Lahiji’s conference list, it’s the DOMINANT chart pattern for companies both in 2009 and 2010…that is if the companies manage to even stay in business until year end as message board favorite/Lahiji conference attendee EGMI succumbed early and had a host of fraud charges too)

Typical Lahiji Conference Company Stock Chart

Typical Lahiji Conference Company Stock Chart

ypical Lahiji Conference Company Stock Chart

ypical Lahiji Conference Company Stock Chart

I’m glad that Lahiji, despite the damning statistical evidence against him, has grown his conference each year from 64 to 80 to this year’s turnout of 100 companies because it just gives us more opportunities to short sell…no different from the 70+ pump and dumps which dropped 90%+ listed in this video (actually there are some overlaps in this video with Lahiji conference companies, SEC go hmmmmm)

…so Lahiji and friends, please do WHATEVER it takes, whether hiring promoters, issuing misleading press releases, luring in naive investors, etc. to get these stock prices up so that we logical and data-based traders can short sell these carcasses at inflated prices, gratzie, Happy New Year!

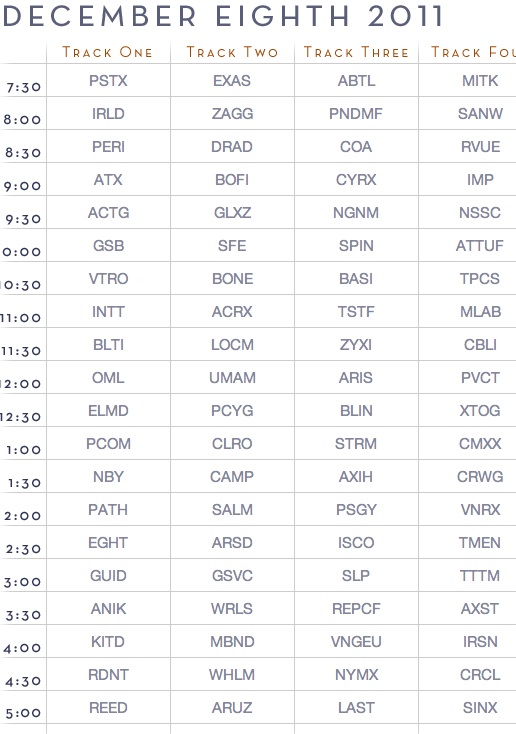

Here’s THE BEST STOCKS FOR 2012 (to short sell) list!

LDMmicro Conference 1

LDMmicro Conference 1

LDMmicro Conference 2

LDMmicro Conference 2

Speak Your Mind