Whole Foods reports their fiscal q1 ’12 Wednesday night after the close with the Street consensus expecting $0.60 in eps on $3.38 bl in revenues for expected year-over-year growth of 18% and 13% respectively. Estimates have changed little since the November earnings report was issued.

Robust comp’s have driven the WFM story as the best-in-class retailer has comped in the high 8% - low 9% range since January 2010. A note out of Jefferies yesterday noted that HainCelestial’s recent quarterly earnings report discussed US Consumption trends of 7% indicating that current trends within the sector remain favorable. A note out of Deutschebank thinks a 10% ID comp for q1 ’12, may not be out of the question.

Store margins for WFM are still below prior peaks too. (Gross margins average 34% - 35%, while operating margins average 5% - 6%.)

Therein lies the rub: lots of bullish commentary around the stock pre-earnings.

WFM is approaching its early ’06 all-time high print near $80 per share currently, so there are the makings of a technical “double-top” in the charts. Also, in November 2005, WFM put out a $12 bl sales goal” which they are already close to 85% achieving. Id like to hear the next step in terms of opportunities for the retailer. Since the ’08 - ’09 recession, the retailer has moved to smaller stores and boosted productivity, so we need to hear about the next opportunity.

For the full year 2012, WFM is expected to grow revenues 14% and eps 18%, which is pretty consistent with growth in the early and mid 2000′s.

The stock isnt cheap on a valuation basis: at its current price its trading about 18(x) cash-flow. We’ve been buying and selling all the way up. we dont have a full position currently, because of the valuation, but i also havent decided what to do with the stock pre-report. I dont like all the positive commentary coming into earnings, but the retailer has executed flawlessly. I expect WFM will act like SBUX did last week - good numbers, good guidance, with all the optimism already priced in.

WFM in now a world-class retailer. The valuation is lofty. I will wait and see how earnings play out, and watch that $80 level, or the $79.90 ’06 high. A trade above that level on volume and we coul run to $100.

(Long WFM and SBUX - would add more on weakness)

Related posts:

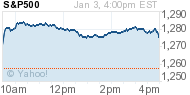

-0.69%

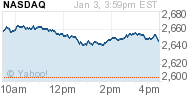

-0.69% -0.80%

-0.80%