By this time, I would think that it would be worth the the time of penny stock promoters to put a big red X over my house, and not send me any more promotions. But alas, I got another one, Stevia First, Inc. This is a weird one, a really, really weird one, as I will attempt to explain.

Stevia First [STVF] was originally Legend Mining, which was based in China, and was looking for diamonds in Canada, much as Nova Mining may be doing. Any organization flexible enough to switch industries from mining to agriculture is probably no well-managed. The two skill sets are very different.

Stevia First was a subsidiary of Legend Mining, but through a reverse merger, it became the parent company in 2011. In the process, the majority of the stock was sold to a new CEO, but that has happened before with this company. The original interests in the company were priced at a pittance, giving large profits to those who sold them. The original shares were sold for a small fraction of a penny, and now trade for nearly $2/share.

And what has the company done to deserve this increase in value? Less than nothing because:

- There have never been any revenues

- Income has always been negative

- Net worth is decidedly negative

That is similar to so many promoted penny stocks. The valuation is absurd, but remember absurd is like infinity. Twice infinity is still infinity. Twice absurd is still absurd. “The market can remain insane longer than you can remain solvent, as Keynes once said.

I think that the price is so high because speculators are manipulating the price, thinking they can profit off of the momentum, and exit before the crash. Why do I think this?

Well, as I researched this, reading through the SEC documents, and Googling some search terms, I ran across a series of websites promoting penny stocks, and tracking the promotion of penny stocks. This was new to me, if there is anyone in my readership that has a more cogent explanation than I am about to give, please give it in the comments.

Here are some of the websites for Stevia First:

- News Letters (Lists promotions & payments for Stevia, and other companies)

- Update: Technical Report on Stevia First Corp. (STVF) – Bullish (ordinary tout citing public sources and no data)

- STVF set to outperform all Chuck Hughes’ 119 winning picks! (a goof of an analyst that does not analyze the company)

- STVF set to outperform all Chuck Hughes’ 119 winning picks! Same.

- Chuck Hughes Microcap Report Same.Stevia First Corp. (OTC:STVF) Sweetens the Pot for Investors

- Stevia First Corp. (STVF) Describes the amount of money promoting the stock.

- Breaking- STVF is Our New Monster Momentum Pick! The Stevia Industry is Hot – Must Read (Note how they make it look like MarketWatch… no analysis, just a lot of bluster)

- Stevia First Corp. (OTC:STVF) Sweetens the Pot for Investors (Recycles a lot of data about the Stevia plant, but little about the company.

- Stevia First Corp. (STVF) Opens Headquarters In California’s Agriculturally Rich Central Valley(And why, pray tell, is Seeking Alpha allowing penny stock touts to disgrace their site?) The company doesn’t have the money to build a headquarters or a plant, unless they do a massive PIPE to bring in cash. Watch out longs!

- QualityStocks News – Stevia First Opens Headquarters in California’s Agriculturally Rich Central Valley Same.

When I write about penny stocks, I usually print out the juicy parts of the disclosure because that explains the story, and so I will do here. It was in 5-point type. It is a blur until I do OCR. Maybe we could have a rule that says disclosures must be made in the same font as the largest print in the document. My but that would cramp their style.

Chuck Hughes and the Microcap Alert Newsletter OWNS NO SHARES, OPTIONS, WARRANTS in Stevia First, Inc (STVF). Also, Stevia First, Inc. has neither approved nor paid for this specific advertisement. Readers should perform their own due diligence. The information presented is provided for information purposes only and the endorsement is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities. Endorser has not taken any steps to ensure that the securities referred to in this report are suitable for any particular investor.

My but that is lousy work. Every evening, even though I make mistakes, I endeavor to make sure that what I write will help people. But what of the promoter?

Conmar Capital, Inc., the third party advertiser, has paid $869,500 to Diamond Spot Media, LLC (DSM) as of March 7, 2025 for this advertising effort in an effort to build investor awareness. DSM shall retain any amounts over and above the cost of creating and distributing this advertisement which advertises Chuck Hughes, Microcap Profit Alert Newsletter coverage of Stevia First, Inc. Advertising services include; production, outsourced advertising copywriting services, mailing and other related distribution services and advertising media placement costs. Conmar Capital, Inc., the third party advertiser, is a company based In Belize City, Belize. Conmar Capital, Inc., the third party advertiser, has represented to DSM in writing that it does not own any shares of Stevia First Inc. except for restricted stock which Conmar Capital, Inc. has represented to DSM in writing that it will not sell, pledge or hypothecate or otherwise agree to dispose of forgo days following the initial dissemination of this advertisement Conmar Capital, Inc. has also represented to DSM in writing that neither it nor its affiliates will buy or sell any shares of Stevia First, Inc. during the period that this advertisement is being disseminated by DSM or third party media vendors.

Wait. Let me get this straight. You paid $870K for the mailing, and from what I can tell, more than $2 million for advertising in entire so far, and all you have is restricted stock? With 2/3rds of the stock in the hands of the new and old CEOs, how can they make money?

Here are some ideas:

- Since the start of the promotion, they have pushed the stock up from nearly 80 cents to nearly two bucks. That’s a 150% gain. To cover the $2.4 million paid, they would have had to own at least 2 million shares. That’s not impossible, but remember, rocket up, rocket down. Tough to lock in the gain.

- Maybe they have some implicit, quiet deal with Stevia First management. After all, they stand to benefit the most from this. If I were part of the Stevia First management, I would be looking to do some sort of dilutitive deal (like a PIPE) to bring real cash into the company, and allow the company to last.

- Maybe penny stock promoters are getting more slick. They don’t speculate on their own deals, but on the deals of others. Working as a greater group, they earn more money off the rubes that speculate on penny stocks.

- Maybe they think the pump will hold the price up long enough that they can sell their restricted stock for a profit.

So how well has the pump and dump been working so far? Pretty well. But that says nothing about the future. This is a company with no equity, no income, no assets, no stable management team. It’s all air. There are no patents that they own on Stevia. There are no barriers to entry, so why should an obscure company be worth anything when it has no sustainable competitive advantage?

So far on the penny stocks, I am batting one thousand. In my opinion, Stevia First will not be an error on my part, but only on the part of those that buy this company.

Related posts:

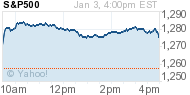

-0.13%

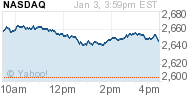

-0.13% +0.16%

+0.16%