Employment is crucial. Everyone wants to know whether the economy is improving and, if so, by how much. Employment is the key metric since it is fundamental for consumption, corporate profits, tax revenues, deficit reduction, and financial markets.

We have an accurate count on employment gains from state unemployment insurance offices, but there is a significant delay in compiling and reporting the data. We just got the numbers for Q311. We would all like to have this information sooner.

Let us call the actual data what it is: The Ultimate Truth.

The truth for the April report is something that we will not know for about eight months. There are various methods for estimating what the Ultimate Truth will be. The BLS has one method, but there are other approaches.

To get the sense of this let us revisit the most recent actual data, from Q311. We now know that total employment increased by 750K jobs during that quarter.

The difference between the number of gross job gains and gross job losses yielded a net employment change of 753,000 jobs in the private sector during the third quarter of 2011. This is the largest net job gain since the first quarter of 2006.

So what were we really thinking at the time?

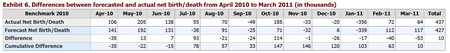

The total of the initial BLS reports was 220K, including a scary “0″ for the month of August. The initial ADP estimates (private employment only) totaled 296K. If you look at a BLS data series now it shows the reports for that quarter to total 383K, including the “benchmark revision” from last March. The final series will be revised even higher when we get the new benchmark revisions next March, since the BLS estimates seem to be running lower than reality.

How Wrong this Is

One of the talking heads on CNBC today was saying that ADP “missed” the BLS number by an average of 48K per month. This is complete silliness, since the scorecard used was based on the initial BLS estimate. It is like asking a forecaster to predict someone else’s erroneous estimate instead of the truth.

The investing world should belatedly accept a proposition that I have been offering for years:

The BLS method is one of several approaches for estimating the truth. Those seeking truth should consider each sound alternative method, and draw conclusions from the composite.

This previous article in the series summarized the various blunders the experts make each month.

I will have more on the investment perspective in the conclusion, but first, what are we looking for tomorrow?

The Data

We would like to know the net addition of jobs in the month of April.

To provide an estimate of monthly job changes the BLS has a complex methodology that includes the following steps:

- An initial report of a survey of establishments. Even if the survey sample was perfect (and we all know that it is not) and the response rate was 100% (which it is not) the sampling error alone for a 90% confidence interval is +/- 100K jobs.

- The report is revised to reflect additional responses over the next two months.

- There is an adjustment to account for job creation — much maligned and misunderstood by nearly everyone.

- The final data are benchmarked against the state employment data every year. This usually shows that the overall process was very good, but it led to major downward adjustments at the time of the recession. More recently, the BLS estimates have been too low. (See my prior preview for a more detailed account of this, along with supporting data).

I think the BLS is honest and does a good job, which seems to put me in a small minority of observers.

In particular, I want to highlight the many know-nothing pundits who roll their eyes about the birth/death adjustment whenever it helps their spin. Two points:

- The birth/death adjustment is one of two methods for estimating new job creation, and it is far less important than the imputation step. This is where the BLS assumes that companies dropping out of the sample are replaced by new companies with similar job characteristics. Don’t hold your breath waiting for someone on CNBC to describe this, since they never have — despite the importance.

- The birth/death adjustment has been very accurate. Here the data from the latest update showing a total error of only 12K jobs in a year. Amazing!

Why doesn’t anyone ever explain how the birth/death adjustment works, the imputation step, or how accurate it has been. Instead, the media endorses the wrong-headed and pervasive skepticism about job creation.

Competing Estimates

The BLS report is really an initial estimate, not the ultimate answer. What we are all looking for is information about job growth. There are several competing sources using different methods and with different answers.

- ADP has actual, real-time data from firms that use their services. The firms are not completely representative of the entire universe, but it is a different and interesting source. ADP reports gains of only 119K private jobs. Steven Hansen at Global Economic Intersection endorses the ADP method over the BLS result. He has a strong analysis covering many nuances in the data. For those who really want to understand the jobs story, it is well worth reading.

- TrimTabs looks at income tax withholding data. The idea is that this is the best current method for determining real job growth. TrimTabs forecasts gains of about 116,000. They have been pretty bearish on job growth, but their approach is worth serious consideration.

- Economic correlations. Most Wall Street economists use a method that employs data from various inputs, sometimes including ADP (which I think is cheating — you should make an independent estimate). I use the four-week moving average of initial claims, the ISM manufacturing index, and the University of Michigan sentiment index. I do this to embrace both job creation (running at over 2.3 million jobs per month) and job destruction (running at about 2.1 million jobs per month). In mid-2011 the sentiment index started reflecting gas prices and the debt ceiling debate rather than broader concerns. When you know there is a problem with an input variable, you need to review the model. For the moment, the Jeff model is on the sidelines.

- Briefing.com cites the consensus estimate as 167K and their own forecast is for 145K.

Trading Implications

What does this mean for our trading and investing? Caution.

I am concerned about a big miss this month. There is too much focus on the initial number. Take a look at this assessment of revisions from Scott Murray at The Stock Sleuth (now added to our featured sites).

2011 Initial Release Revision Net Change

August 0 104,000 +104,000

September 103,000 210,000 +107,000

October 80,000 120,000 +40,000

November 120,000 157,000 +37,000

December 200,000 223,000 +23,000

January 243,000 275,000 +32,000

February 227,000 240,000 +13,000

March 120,000 ????

In the past I have suggested that revisions were not predictable. The first two come mostly from additional responses to the survey. More recently we have the effects of “concurrent seasonal adjustments” as well as the benchmark revisions. I have a concern that the seasonal adjustment method does not work as well at market turning points, helping to explain why the initial reports have been too low.

While the evidence all suggests continuing economic growth in the 2- 2.5% range, this report could easily be a disappointment. While I am seeking buying opportunities and new positions for long-term accounts, it usually pays to be cautious before the employment report. That may be especially true this month.