Understanding risk is the most important part of investing. Distinguishing risk from fear is a crucial to this knowledge.

In my regular commentary I emphasize the difference in time frames between traders and investors.

- The trader is making a short-term forecast, booking gains and losses on an hourly, daily, or weekly basis. The trader is trying to anticipate the next market move.

- The investor is more interested in the fundamental value of a company – a long-term forecast of value and price.

Because of the difference in time frames, it is quite possible for traders and investors to be on opposite sides of a trade – and both might be right!

Edge and the Long Run

A crucial concept in evaluating a market system relates to how long it takes to get into the “long run.”

If you have only a small edge, you need many trades to reach the long run. The top trading banks report almost no days on which they have losses. This means that they have thousands of small arb-style trades, or deals with clients on both sides. They are locking in profits and not taking overnight positions.

The HFT firms do not have losses in time periods measured in hours – not even a full day. Once again, they take a small profit and lock it in. It is similar to a Vegas casino with hundreds of tables of blackjack and roulette. A small edge is enough.

The average trader or investor cannot do this volume nor profit from such a small edge. You need to start with more edge, and also have more patience in reaching the long run.

This is the single most important concept to understand – the interplay among your edge, your timing and your expectations.

Let’s take a look at the current market for an informative example.

Traders

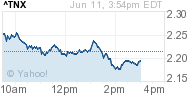

In last week’s WTWA article I highlighted the market vulnerability for this week – fear leading to more fear. It is a thin week for volume with many big players on vacation. It would be easy for a relatively small market move to get a big play, leading to a cascade of selling. There are many market participants who profit from a decline – and I provided a roster. There hopes were fulfilled when Sec. Kerry discussed a possible attack on Syria.

I actually thought this was one of my better entries in the WTWA series, but it had a smaller than normal following. Too bad. I highlighted Syria as the big risk and also mentioned that any move might be exaggerated.

Investors

While I always highlight short-term issues, I also try to emphasize fundamental analysis. I understand that every investor would like to dart in and out of the market to catch every 5% move. What happens much more often is that you get out and never get back in.

The long-term investor is better-served by careful attention to fundamentals – including the following:

-

Attractive valuation based on future expectations for corporate earnings. I have frequent posts on this theme, but check out the following for the most recent themes:

- http://oldprof.typepad.com/a_dash_of_insight/2013/07/beating-buy-and-hold-understanding-earnings.html

- http://oldprof.typepad.com/a_dash_of_insight/2013/07/how-to-profit-from-the-shiller-cape-ratio.html

- Little risk of recession. Corporate earnings forecasts are solid unless there is a recession.

- Small financial risk – documented by the excellent SLFSI weekly analysis.

These are the real measures of risk. We respect actual, documented risk and you should as well.

Fear

By contrast, there is a current avalanche of crash-style predictions. Most of these come from various omens or syndromes. This happens when pundits start with a conclusion and mine data until “causes” are found. I am chipping away at this misleading information, but I can only do so much.

There is another group of pundits who are selling books, seminars, or page views. If you could have a personal chat with Mr. Buffett, he would explain to you why you should be ignoring them all, focusing on the value of the businesses and the price currently offered by Mr. Market.

(Since Mr. B is not available, you may request my report, “Understanding Risk” by writing to Feray at main at newarc dot com).

Meanwhile, investors should chill out and do some shopping. There are many attractive stocks, especially in cyclicals (CAT, FCX), financials (JPM), and technology (ORCL, MSFT, INTC, and AAPL).

Looking Ahead

I certainly cannot promise that tomorrow’s prices will be the bottom, but I do find them attractive. Just suppose that some attack is made on Syria on Thursday – quite possible. The investment “A” teams are on vacation, but will come back on Tuesday. Everyone will start looking at stocks based upon 2014 earnings expectations. The world will look a little better.

The average investor should not be trying to time these market events and should not believe those who claim this power. It is much better to have a list of stocks with solid buy targets, acting when opportunities present.

+0.81%

+0.81% +1.00%

+1.00% +1.72%

+1.72%