Reports of a new U.S. warfront in Syria after reports of chemical weapons use is driving a market panic. As always we have no choice but to address what this means to our stocks and options and portfolios.

First to be sure, my heart and prayers go out to everybody on every side of the conflict in Syria. It’s more impossible than ever to comprehend how killing one man in one area with centuries of conflict behind it can help anybody. But it seems once again that our Republican/Democrat regime and its corporate war-machine masters are hellbent on continuing to fuel and escalate the Middle East wars.

I personally think that so long as the R/D regime forces wartime upon the nation, it should also force the nation to sacrifice in the same way it did in WWI and WWII. A Rod and I should be sent to pilot school and then on missions in the same way all able-bodied men had to join the wars back then. How can the Iraq, Afganistan (and now the Syrian wars) extend longer and cost more than WWI and WWII combined?

If we need to fight in the Middle East so badly, why don’t we force the entire nation to ration commodities, networks and anything else that could help our troops?

These are hard and complicated and touchy topics and that is exactly why we need to be discussing them as citizens of the world. And it’s also why we need to try to be objectively addressing in our investment portfolios on an ongoing basis.

Finally, as for history on how to trade a war breakout like this, I would refer to when the R/D regime sent our troops into Iraq back in March 2003 (which was also like the Operation Desert Storm market action). The panic into the invasion was palpable and by the time it was being broadcast into people’s living rooms via “imbedded media” TV reporters, the markets had put in a big-time bottom before taking back off and resuming its bubble blowing.

Here’s a look back at how the time, set up and outcome from Operation Iraqi Freedom from my Choose-Your-Own-Adventure-esque book/site called Events That Mattered (Or Did They?).

The upshot is that I wouldn’t look to rush into the longs here but if and when the R/D regime formally sends in troops and/or weapons and/or whatever support for whatever side they say we’re supposed to be cheering for this week, I would likely cover shorts and sell puts and probably buy some call options too. But nothing of serious size or anything meaningful in changing our portfolio exposure. We’ve been warning people to prepare for the “next crash” since the markets topped earlier this summer. We’ve been preparing for this ourselves by buying gold and silver when they were crashed and hedging/trimming our stock portfolios near the highs.

I am however selling some more of our VIX call options for triple of what we paid two weeks ago when the markets were complacent. That’s just part of the playbook. I’m down to less than 1/3 of my initial VIX call position now.

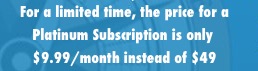

I also want to remind everyone that I offer a free subscription to TradingWithCody.com to all active military service men and women. Thank you for serving.

Cody Willard writes Revolution Investing for MarketWatch and posts the trades from his personal account at TradingWithCody.com, which is not affiliated with MarketWatch. At time of publication, Cody was net long Vix, gold and silver. Follow Cody on Twitter at twitter.com/codywillard.