I have many software robots that scan for responses to what I write. Most come directly to me. Some do not like this one at Seeking Alpha:

Merkel’s reasons are, to be blunt, stupid.

1: Its too crowded and there is too much competition: While his goals may be to outperform many of us just want to build wealth.

2: Too much information: Just ignore the stuff that is unimportant. More information the better it certainly beats how things were decades ago.

3: “We are in a macroeconomic environment where we are delevering. That is not the best environment for making money”

For someone claiming 20 years of experience that is incredible naive.

First, we build wealth in competition with others, and the competition has grown, not shrunk. The anomalies the allowed smaller investors to prosper are for the most part well-known. Whether they are over-fished is another matter. I think that previously profitable strategies still have value to the degree that they are ignored as no longer valuable.

Second, yes there is way too much noise, and I even create some of it. Yes, I try to filter the information I receive, but I receive a ton of it, and filters are not perfect. Please tell me how to construct a perfect filter, because mine are imperfect. If we could create perfect filters we would be very, very rich, unlike me and the commenter.

Third, I don’t get the last comment, except that the person does not understand that periods where lending is expanding usually offers the highest returns for risk assets. Presently we are contracting.

If I am naive, it is that I am an idealist. I want better economic policy, and see lousy governance at the Fed, Treasury, and State levels. As a result, on average, I see low real returns for assets over the next 5-10 years, unless policy changes dramatically.

Related posts:

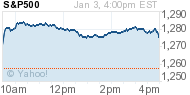

-0.14%

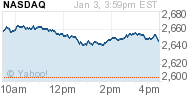

-0.14% -0.27%

-0.27%